Page 90 - Safaricom Foundation Annual Report 2020-2021

P. 90

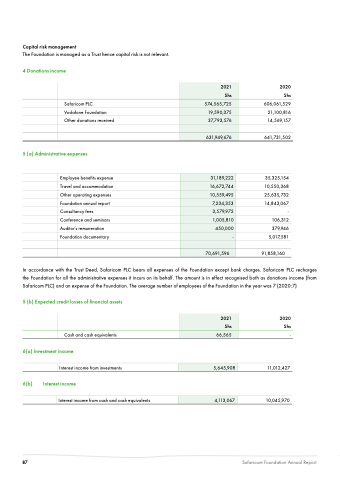

Capital risk management

The Foundation is is is managed as a a a a a a a a Trust hence capital risk is is is not relevant 4 Donations income

Safaricom PLC Vodafone Foundation Other donations received

5 (a) Administrative expenses

Employee benefits expense Travel and accommodation

Other operating expenses

Foundation annual report

Consultancy fees

Conference and seminars

Auditor’s remuneration

Foundation documentary

2021

Shs

574 565 725

19 590 375

37 793 576

631 949 676

2020

Shs

606 061 529 21

100 816 14 569 157

641 731 502

35 325 154 10 550 368 25

635 732 14 843 067

- 106 312 379 946

5 5 017 581

91 858 160

31 189 222

16 672 744

10 559 495

7 234 353

3 579 972

1

1

005 810

450 000

- 70 691 596

In accordance with the the Trust Deed Safaricom Safaricom PLC PLC bears all expenses

of the the Foundation except bank charges charges Safaricom Safaricom PLC PLC recharges the the Foundation for all the the administrative expenses

it it incurs on on on on its behalf The amount is is is in in in in effect recognised both as donations income

(from Safaricom PLC) and an an expense of of of the the the Foundation Foundation The average number of of of employees of of of the the the Foundation Foundation in the the the year was 7 7 (2020:7)

5 (b)

Expected credit losses of financial assets

Cash and cash equivalents

6(a) Investment income

2020

Shs

- 11 012 427

10 045 970

2021

Shs

66 565 6(b)

Interest income

from investments

Interest income

Interest income

from cash cash and cash cash equivalents

5 5 645 908

4 113 067

87 Safaricom Foundation Annual Report