Page 89 - Safaricom Foundation Annual Report 2020-2021

P. 89

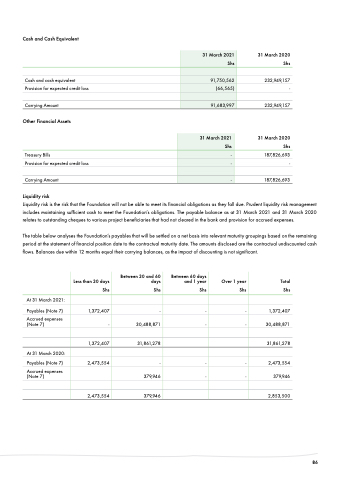

Cash Cash and Cash Cash Equivalent

31 March 2021 Shs 91 750 562

(66 565)

91 683 997

Cash and cash equivalent Provision for expected credit loss Carrying Amount

Other Financial Assets

Treasury Bills

Provision for expected credit loss Carrying Amount

Liquidity risk 31 March 2020 Shs 232 949 157 - 232 949 157 31 March 2020 Shs 187 826 693 - 187 826 693 31 March 2021 Shs - - - Liquidity risk risk risk is is is is the the the risk risk risk that the the the Foundation will not be able to meet its financial obligations as they fall due Prudent liquidity risk risk risk management includes maintaining sufficient cash to meet the Foundation’s obligations The payable balance as as at at at 31 31 March March 2021 and 31 31 March March 2020 relates to to outstanding cheques to to various project beneficiaries that had not cleared in in the bank and and provision for accrued expenses The table below analyses the the Foundation’s payables that will be be settled on on on a a a a a a a a a a a a a net basis into relevant maturity groupings based on on on the the remaining period at at at at at the the the statement of financial position date date to the the the contractual contractual maturity date date The amounts disclosed are the the the contractual contractual undiscounted cash flows Balances due within 12 months equal their carrying balances as the the impact of discounting is is not significant At 31 March 2021:

Payables

(Note 7)

Accrued expenses (Note 7)

At 31 March 2020: Payables

(Note 7)

Accrued expenses (Note 7)

Between Between 30 and and 60 60 Between Between 60 60 days

days

Less than 30 30 days

days

days

days

days

days

and and 1 1 year year Over 1 1 year year Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs Shs 1 372 407 - - - - - - - - - - - - 30 488 871 - - - - - - 1 1 1 372 407 31 861 278

2 473 554 - - - - - - - - - 379 946 - - - - 2 473 554 379 946 Total Shs 1 372 407 30 488 871 31 861 278

2 473 554 379 946 2 853 500

86