Page 46 - Safaricom Foundation Annual Report 2020-2021

P. 46

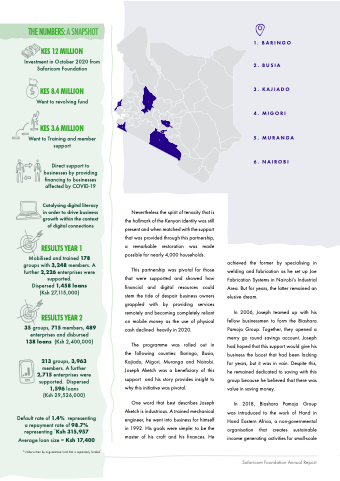

THE NUMBERS: A A SNAPSHOT KES 12 MILLION

Investment in October 2020 from Safaricom Foundation

KES 8 4 MILLION

Went to revolving fund

KES 3 6 MILLION

Went to Training and member support

Direct support

to businesses by providing financing to businesses affected by COVID-19

Catalysing digital literacy in in order to drive business growth within the context of digital connections

RESULTS YEAR 1 Mobilised and trained 178 groups with 3 248 members A further 2 2 2 226 enterprises were supported Dispersed 1 458 loans (Ksh 27 115 000)

RESULTS YEAR 2 35 groups 715 members 489 enterprises and disbursed 138 loans (Ksh 2 400 000)

213 groups 3 3 3 963 members A further 2 715 enterprises were supported Dispersed 1 596 loans (Ksh 29 526 000)

Default rate of 1 4% representing a a a repayment rate of 98 7% representing *Ksh 315 957

Average loan size = Ksh 17 400 *Underwritten by a a a a a a guarantee fund

fund

that is separately funded 43

1 1 BARINGO 2 BUSIA

3 KAJIADO 4 MIGORI

5 MURANGA 6 NAIROBI

2 4 5 6 3 Nevertheless the the spirit of tenacity that is the the hallmark of the the Kenyan identity was still present and when matched with the support

that was provided through this partnership a a a a a a remarkable restoration was made possible for nearly 4 000 households This partnership was pivotal for those that were supported and showed how how financial and digital resources could stem the tide of despair business owners grappled with by providing services remotely and becoming completely reliant on

on

mobile money as the use of physical cash declined heavily in in 2020 The programme was rolled out in the following counties: Baringo Busia Kajiado Migori Muranga and Nairobi Joseph Aketch was a a a beneficiary of this support

and his story provides insight to to why this initiative was pivotal One word that best describes Joseph Aketch is industrious A A trained mechanical engineer he went into business for himself in 1992 His goals were simple: to be the master of his his craft and his his finances He

achieved the former by specialising in in welding and fabrication as he set up Joe Fabrication Systems in Nairobi’s Industrial Area But for years the latter remained an elusive dream In 2006 Joseph teamed up with his fellow businessmen to form the Biashara Pamoja Group Together they opened a a a merry go round savings account Joseph had hoped that this support

would give his his business the boost that had been lacking for years but it it was in in vain Despite this he remained dedicated to saving with this group because he he believed that there was value in in saving money In 2018 Biashara Pamoja Group was introduced to the work of Hand in in Hand Eastern Africa a a a a a non-governmental organisation that creates sustainable income generating activities for small-scale

Safaricom Foundation

Annual Report